For first-time buyers and older people looking to downsize in the Dutch capital there is good news, according to estate agent association NVM: house prices have fallen year-on-year in Amsterdam.

Sales by NVM agents in the second quarter of 2025 – seen as an early indicator for the whole market – suggest Amsterdam prices fell by 0.4% compared with the same period in 2024.

It is unclear whether this is the “canary in the coalmine” for a correction in the overpriced Dutch property market. Floris van der Peijl, chairman of Amsterdam agent group MVA, said the capital was particularly affected by investors selling buy-to-let properties.

“There is a significant rise in houses for sale and buy-to-let investor sales play a strong role, especially in Amsterdam,” he said. “Some estate agents have half of their supply from former buy-to-lets. More and smaller apartments of a lower quality are being sold, these are cheaper and have an effect on the average price.”

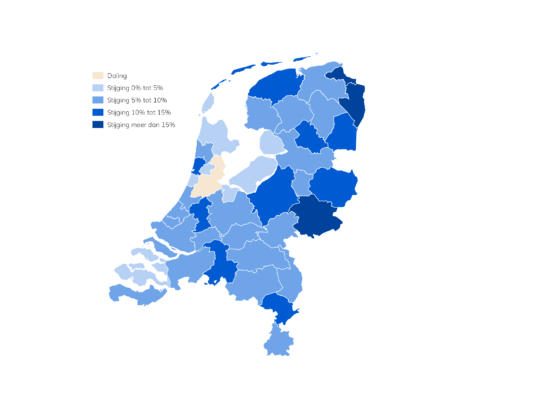

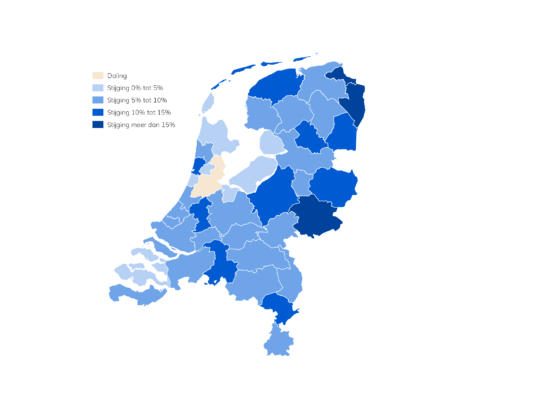

There was more property coming on the market than at any time since 2008, with 52,116 new properties put on sale between April and June, said NVM chair Lana Goutsmits-Gerssen. This means that the annual price rise across the country is also far less steep than at the start of the year.

“We see the price rise weakening to 6.2%,” she said at a press conference in Utrecht. “The most important cause is the increase in supply from former buy-to-lets. They are often smaller homes, of lower quality and that has a downward effect on the average price.”

She added that there is a positive effect, particularly for people who want to buy a house. “The general feeling is positive – there is more choice for consumers and sellers can sell quickly and for good prices, while supply and demand come closer together.”

The NVM said that sales of buy-to-let apartments appear to have reached a stable level but while they mean more availability for buyers, rental supply in some areas has dried up. Van der Peijl said there were indications that internationals working temporarily in the Netherlands were looking to buy a house rather than rent when their current contract expired.

New build

Meanwhile, foreign investors are less inclined to invest in Dutch new-build and supply does not match demand for older people who might want to downsize, but still want a reasonable-sized apartment with a garden.

“The situation is just disastrous for a lot of people,” said Goutsmits-Gerssen. “Not everyone can buy a house, because they simply can’t or don’t want to, or have work circumstances. If people are divorcing, for instance, one needs to leave the house but cannot buy: this can lead to appalling circumstances…Not much is coming in the mid-price range and that is problematic.”

The agent group said its agents – who represent “around 70%” of total sales – sold around 42,000 homes in the second three months of the year, almost a quarter more than at the start of the year and 15% more than the same period in 2024.

A new law banning two-year contracts and limiting prices for mid-level rentals means that many buy-to-let landlords are selling their assets to find a better return elsewhere.

However the Kadaster land registry has reported that although many small investors are selling up, the overall number of rental homes is roughly stable due to major investor purchases and new build.

Expats

While the NVM said last year that internationals represented 2% of sales, and some 10% in Amsterdam, Van der Peijl said in Amsterdam and Eindhoven, more “expats” were buying now. “You do see a shift,” he said. “Expats who would rent can’t find rentals so they are all going onto the sale market.”

But in a list of seven measures for election manifestos, the NVM argued to extend an unusual Dutch tax subsidy for homeowners which the finance ministry, DNB central bank and the European Commission say increases risky debt and means property is overpriced according to EU measures and climate risks.

Estate agents themselves have also recently come under fire. An investigation by RTL Nieuws cast doubt on the reliability of the site Funda – part owned by the NVM – claiming some properties listed as “new” had been on sale for months at higher prices. One frustrated buyer, who has made a formal complaint about estate agent practices, has questioned the integrity of house auction processes.

The NVM measures the median sale price of “sale contracts”, while CBS national statistics calculate a weighted average of all properties at the point of actual exchange, which also takes into account the quality of the homes.